Forget all this talk about giant “spending cuts” of $6.2 trillion in Congressman Ryan’s budget plan. That’s music to my ears, but it’s also based on Washington’s bizarre budget math – i.e., the screwy system where politicians can increase spending but say they’re cutting spending because the budget could have grown even faster.

What really matters is how much money government is spending this year compared to how much money will be spent in subsequent years. Using this common-sense benchmark, let’s look at two competing proposals.

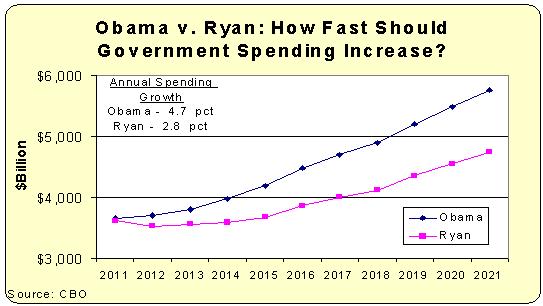

According to the new numbers released today, Congressman Ryan’s budget plan will result in government growing, on average, by almost 2.8 percent annually over the next 10 years.

President Obama’s budget plan, by contrast, would increase the burden of government spending by an average of nearly 4.7 percent each year.

This chart compares the two budget plans. Because Chairman Ryan does not let spending grow as rapidly, cumulative spending over that period will be $6.2 billion less than it would be based on the President’s plan. That’s an impressive amount of money that taxpayers will save if Ryan is successful, but it’s not a spending cut.

Not surprisingly, the big spenders in Washington are claiming that the “spending cuts” in Representative Ryan’s budget are “harsh” and “extreme.” But Ryan’s proposal would allow the budget to grow faster than inflation, which is projected to average less than 2.1 percent annually over the 10-year period.

Good fiscal policy is very simple. Restrain the size and scope of government so that outlays grow slower than the private sector. If that happens, the burden of federal spending will shrink as a share of economic output

That’s exactly what happens with Ryan’s plan. By 2018, the federal budget will drop to less than 20 percent of GDP. That still doesn’t bring us back to where we were at the end of the fiscally responsible Clinton years, when federal spending consumed only 18.2 percent of GDP. But after a 10-year spending binge under Bush and Obama, Congressman Ryan’s plan would move America back toward fiscal responsibility.