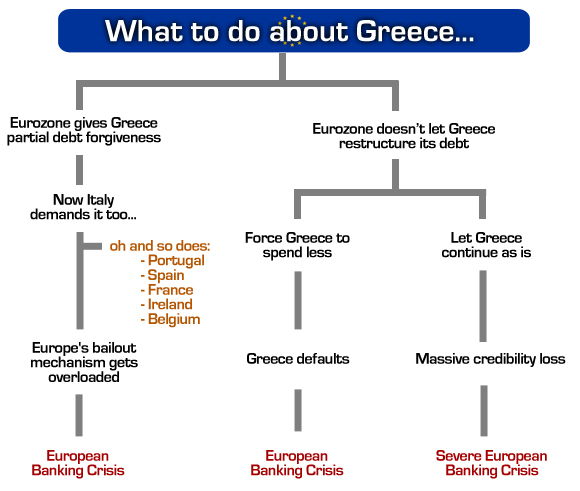

I would have structured this flowchart differently, for reasons I discuss in this post, but this is pretty good picture of why Europe is in trouble.

They say all roads lead to Rome, and this flowchart shows all roads lead to a banking crisis (see this post to understand why).

But not all banking crises are created equal. A bailout (the left column) would inflate the debt bubble and make the ultimate crisis much more devastating.

Cutting Greece loose (the middle column) is the best approach, in part because it would have a sobering effect on other European nations that would like to mooch off the European Union (German taxpayers) or International Monetary Fund (American taxpayers).

Just imagine, by the way, how much better things would be today if Greece had been unable to access bailout money and instead had been forced to spend the last two years implementing real reform. That’s why I stand by everything I wrote in my first post about the Greek mess.