As I’ve noted on previous occasions, I’m not a fan of Ben Bernanke and his actions at the Federal Reserve, though it is possible that QE2 may be the right policy (albeit for different reasons than publicly stated by the Fed Chairman).

I’ve had several people say to me, however, that it doesn’t make sense for the government to engage in an inflationary monetary policy because that will worsen the fiscal situation. Why inflate, after all, if it results in higher cost-of-living adjustments for Social Security recipients and higher pay for government bureaucrats?

My first response is to say that long-run fiscal policy almost surely is not a big (or even little) factor in monetary policy decisions. Central Banks tend to behave poorly for short-run reasons such as financing deficits (a problem in the developing world) or manipulating interest rates in hopes of goosing growth (a problem is all nations).

It goes without saying, of course, that a series of bad short-run policy decisions translates into bad long-run policy, which is why the dollar has lost 95 percent of its value since the Federal Reserve was created.

My second response is to tell folks that we should hope that long-run fiscal policy is not a factor in monetary policy. Because they are right that inflation leads to higher expenditures, but the government reaps a big windfall from higher tax revenue.

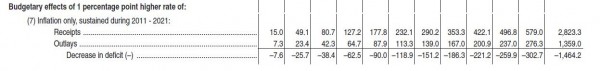

But don’t believe me. You can find this information in Table 3.1 on page 23 of the Economic and Budget Analysis section of Obama’s budget.