After reading below about Argentina’s decline, several people have emailed to ask how Chile compares. Ask and ye shall receive. This post from last month shows shows Chile, Argentina, and Venezuela. Very powerful, which is why I gave the post such a grandiose title.

==============================

There’s been a lot of coverage of the recent decision by Standard & Poor to warn that the United States has a “negative” outlook.

As Joe Biden would say, BFD. I’m stunned that anyone would care, particularly since the rating agencies have zero credibility. These clowns completely missed Enron. They missed the collapse of Europe. They blew it on the financial crisis, especially with regard to the corrupt government-created mess at Fannie Mae and Freddie Mac.

The fact that one of the rating agencies belatedly warns that America is heading in the wrong direction should elicit only one response, which is, “Where were you guys when Bush did no-bureaucrat-left-behind, the prescription drug entitlement and TARP? And where were you guys when Obama did the faux stimulus and government-run healthcare?”

One of the problems with the rating agencies in this regard is that they narrowly focus on the ostensible ability of an institution (such as a company or government) to repay debt. That’s an important consideration, especially if you are a bondholder, but (even if the rating agencies did a good job) it doesn’t tell us much about why a government is in good shape or bad shape.

This story – and the failure to recognize what’s truly important – is doubly irritating to me since I’m in Buenos Aires for the Mont Pelerin Society meetings. Many of the speakers have focused on the challenges in Latin America, with a lot of attention focused on what went wrong with Argentina.

If I was forced to compress all the analysis into one brief answer, the problem is crony capitalism. Argentina’s economy, for all intents and purposes, is one giant Fannie Mae/Freddie Mac/Obamacare/General Motors/Goldman Sachs Obamaesque dystopia. Government has enormous influence over every major economic decision. It’s like being in the middle of Atlas Shrugged, as political connections are the way to get rich.

This type of approach is far worse than the Scandinavian welfare state. Yes, the official size of government is bigger in places such as Sweden, but the negative role of government intervention is far more pervasive in Argentina.

What makes this so tragic is that Argentina used to be one of the world’s wealthiest countries. Last night, I had the privilege of listening to one of the nation’s leading free market advocates, Dr. Ricardo H. López Murphy, talk about Argentina’s history. In the 1800s and early 1900s, Argentina looked to the United States for inspiration (back in the days when government was a far smaller burden) and he noted that his country was remarkably successful.

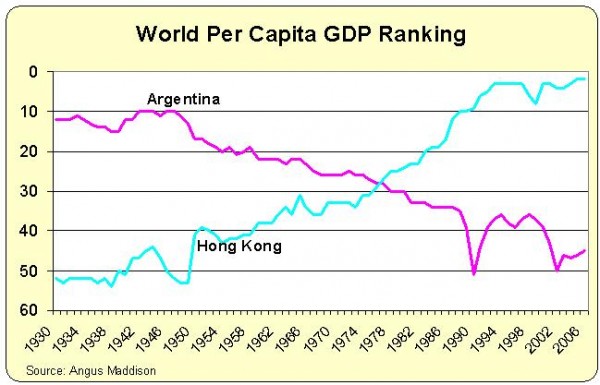

Then, beginning around the 1940s, Argentina began to march in the wrong direction. As you can see from this chart, the consequences have been tragic. The nation’s relative ranking has declined precipitously. A country that used to be one of the world’s richest has now fallen way behind.

I also put Hong Kong on this chart to give further evidence that policy matters. Argentina has pursued an Obama policy of government intervention and has declined. Hong Kong has practiced laissez-faire economics and now is one of the world’s richest jurisdictions.

This is a warning to America. There is nothing magical about the United States. If we copy Argentina (actually, a very bad combination of Argentine-style crony capitalism and Swedish-style high-tax redistribution), we will suffer similar consequences.