President Obama is stubbornly clinging to his ideological agenda of bigger government and class warfare. Wasteful programs magically become “investments” for growth, and higher tax rates get turned into “shared sacrifice.”

Interestingly, we already know what eventually happens with this approach. Europe’s welfare states are now dealing with the wreckage of Obamanomics-type policies and the results are not pretty.

We already know about the fiscal crises in nations such as Greece and Portugal, and it’s probably just a matter of time before Spain, Italy, and Belgium face similar problems (and because of demographics, even the market-oriented welfare states of Northern Europe may be on borrowed time).

To put it bluntly, European nations have spent themselves into a fiscal ditch and they’re now trying to figure out how to deal with the carnage.

But while there’s been lots of attention paid to the spending crisis in Europe, there’s also a very interesting – albeit under-reported – story on the revenue side of the budget ledger.

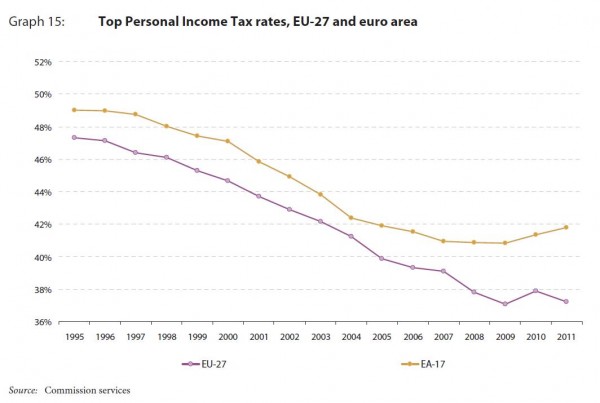

Europeans appear to be learning, slowly but surely, that it is a mistake to saddle an economy with punitive tax rates. Here’s a chart from a recently released European Commission report. It shows average top tax rates for European Union nations (the top line is for the subset of nations that use the euro currency and the bottom line shows the average of all EU nations).

As you can see, the average top tax rate in Europe has dropped by about 10 percentage points since 1995. Perhaps most remarkable, the average top tax on individuals is now down to about 37 percent – lower than the 39.6 percent rate that Obama wants for the United States. And that doesn’t even count the higher payroll tax rate endorsed by the President!

Even the Euro-zone nations have dropped their average top tax rates by about seven percentage points during the period. But what may be most noteworthy is that these nations have been reluctant to rely on class warfare taxes in response to the fiscal crisis. Yes, the overall top tax rate has crept up by one percentage point in recent years, largely thanks to increases in nations such as Greece and Portugal, but that’s an amazingly restrained response – particularly compared to how politicians would have tried to rape and pillage the “rich” if the fiscal crisis happened twenty or thirty years ago.

While it’s a bit risky to draw long-term conclusions from any set of data, it does seem as if the European political elite have finally realized that economic damage caused by class-warfare taxation is greater than any political benefits of pursuing those soak-the-rich policies.

Maybe they’ve learned because there is growing evidence for the Laffer Curve (why raise tax rates, after all, if you don’t get more money to waste?). Or maybe they’ve learned because of tax competition (why raise tax rates if that causes the geese with the golden eggs to fly across the border?).

All we can say for sure, however, is that those same lessons have not been learned in America.