Earlier this year, I wrote about how the person Obama put in charge of Medicare made some very interesting observations about prices, competition, and markets, but then drew exactly the wrong conclusion about what was needed to solve the third-party payer problem in health care.

We now have another example of someone producing very good information and then failing to learn the obvious lesson. Catherine Rampell of the New York Times wrote about how politicians used to be much more willing to increases taxes.

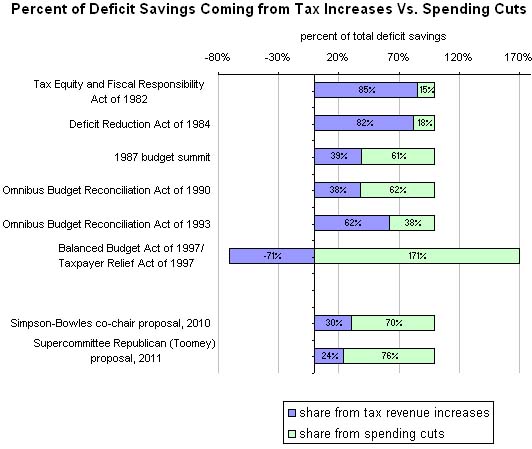

She obviously wants readers to conclude that bad, mean, wicked Republicans are being too dogmatic because they won’t agree to big tax hikes. But the chart she prepared tells a completely different story. The only budget agreement that actually produced a balanced budget was the 1997 deal, and that deal contained tax cuts rather than tax increases!

But don’t believe me. Look at her chart.

I suppose I also should say that her chart is misleading because it accepts the dishonest Washington definition that a “spending cut” occurs any time politicians increase spending by less than previously planned.

And even if one uses that dishonest definition, the make-believe spending cuts usually evaporate very rapidly. The tax increases, unfortunately, are far more durable. And the net result is higher spending and oftentimes more red ink.

But even with those two big methodological shortcomings, her chart is a strong argument that tax increases don’t work.

Two final points. First, anybody who thinks the 1993 tax hike was successful should read this post and you’ll see that the Clinton White House admitted it was a failure in early 1995.

Second, it wasn’t really the 1997 budget deal that produced the budget surplus. The deficit disappeared because we had a period, beginning a couple of years earlier, during which politicians followed Mitchell’s Golden Rule and restrained government spending so that it grew slower than the private economy. The 1997 agreement played a role, but it’s quite likely that red ink would have disappeared anyhow.

Last but not least, the reason we’re in a fiscal ditch today is mostly because Bush abandoned good fiscal policy and let the burden of government spending climb much faster than the productive sector of the economy.