The Economist magazine has a couple of good articles about Australia’s increasingly enviable economic status. Here’s a blurb from the first article, which outlines the pro-market reforms that enabled today’s prosperity.

Only a dozen economies are bigger, and only six nations are richer—of which Switzerland alone has even a third as many people. Australia is rich, tranquil and mostly overlooked, yet it has a story to tell. Its current prosperity was far from inevitable. Twenty-five years ago Paul Keating, the country’s treasurer (finance minister), declared that if Australia failed to reform it would become a banana republic. Barely five years later, after a nasty recession, the country began a period of uninterrupted economic expansion matched by no other rich country. It continues to this day. This special report will explain how this has come about and ask whether it can last.

…With the popular, politically astute Mr Hawke presiding, and the coruscating, aggressive Mr Keating doing most of the pushing, this Labor government floated the Australian dollar, deregulated the financial system, abolished import quotas and cut tariffs. The reforms were continued by Mr Keating when he took over as prime minister in 1991, and then by the Liberal-led (which in Australia means conservative-led) coalition government of John Howard and his treasurer, Peter Costello, after 1996.

…By 2003 the effective rate of protection in manufacturing had fallen from about 35% in the 1970s to 5%. Foreign banks had been allowed to compete. Airlines, shipping and telecoms had been deregulated. The labour market had been largely freed, with centralised wage-fixing replaced by enterprise bargaining. State-owned firms had been privatised. …the double taxation of dividends ended. Corporate and income taxes had both been cut.

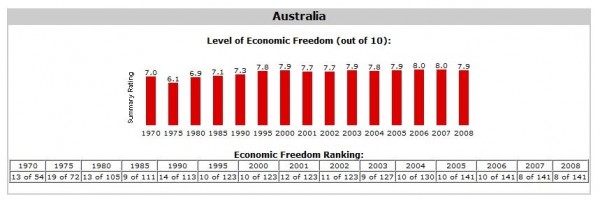

This chart (click for a larger image), from Economic Freedom of the World, presents a more rigorous look at this period. It shows how Australia’s economic freedom ranking had dropped to as low at 19 (out of 72 nations measured) and now is up to 8 (out of 114 nations measured). This is akin to moving from the 74th percentile to the 94th percentile.

There is also an accompanying article about Australia’s private Social Security system. Called superannuation, these personal accounts have generated tremendous results.

There is also an accompanying article about Australia’s private Social Security system. Called superannuation, these personal accounts have generated tremendous results.

…most Australian workers, over 8m in total, now have a private nest-egg for their old age. No tax is paid when members withdraw from their fund; they can take all they want as a lump sum, subject to a limit, or buy an annuity. Aussies are now a nation of capitalists.

At the same time the state pension system, and therefore the taxpayer, is being progressively relieved of most of the burden of retirement provision, since eligibility for the state pension depends on both assets and income. As supers take over, the provision for old folks’ incomes will be almost entirely based on defined contributions, not defined benefits. So Australia is in the happy position of not having to worry too much about the pension implications of an ageing population…

The supers…have created a pool of capital in Australia that might not otherwise have existed. Collectively worth about $1.3 trillion—much the same as GDP—they have made Australia the world’s fourth-largest market for pension savings.

Australia is not exactly Hong Kong. Marginal tax rates are still far too high. The burden of government spending is lower than in the United States, but is still far too onerous. Nonetheless, the Aussies have made impressive strides in reducing the overall size, scope, and level of government interference and intervention. And this has translated into much better economic performance.

This video uses the Economic Freedom of the World index to explain why comprehensive free market reforms (like Australia) generate the best results.