One of my frustrating missions in life is to educate policy makers on the Laffer Curve.

This means teaching folks on the left that tax policy affects incentives to earn and report taxable income. As such, I try to explain, this means it is wrong to assume a simplistic linear relationship between tax rates and tax revenue. If you double tax rates, for instance, you won’t double tax revenue.

But it also means teaching folks on the right that it is wildly wrong to claim that “all tax cuts pay for themselves” or that “tax increases always mean less revenue.” Those results occur in rare circumstances, but the real lesson of the Laffer Curve is that some types of tax policy changes will result in changes to taxable income, and those shifts in taxable income will partially offset the impact of changes in tax rates.

However, even though both sides may need some education, it seems that the folks on the left are harder to teach – probably because the Laffer Curve is more of a threat to their core beliefs.

If you explain to a conservative politician that a goofy tax cut (such as a new loophole to help housing) won’t boost the economy and that the static revenue estimate from the bureaucrats at the Joint Committee on Taxation is probably right, they usually understand.

But liberal politicians get very agitated if you tell them that higher marginal tax rates on investors, entrepreneurs, and small business owners probably won’t generate much tax revenue because of incentives (and ability) to reduce taxable income.

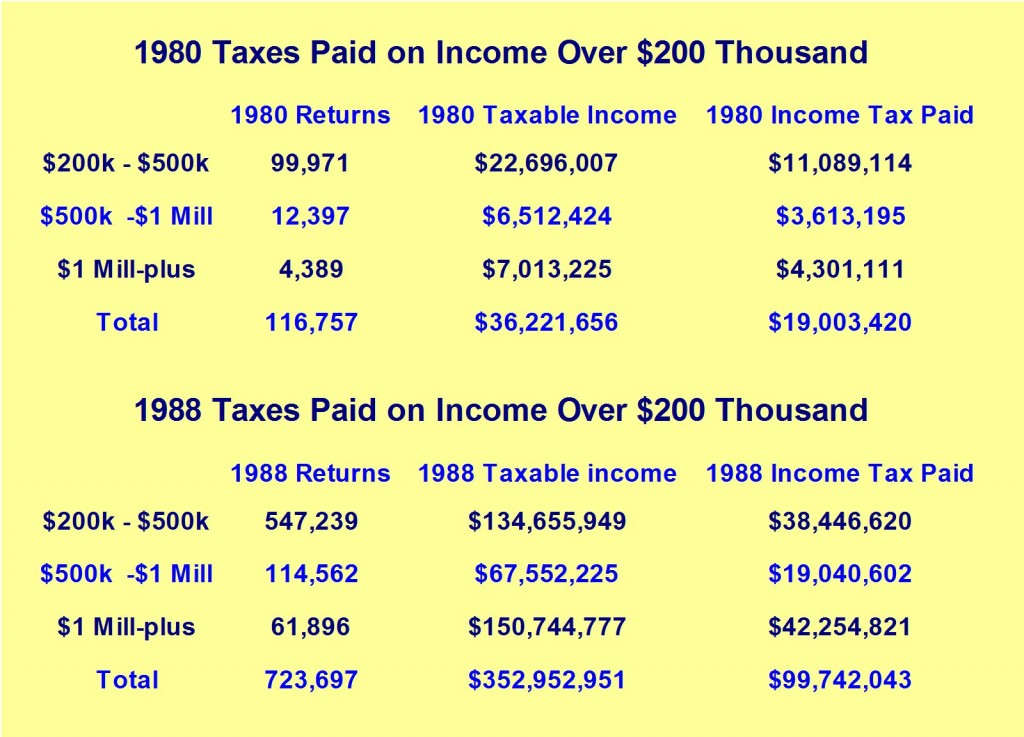

To be fair, though, some folks on the left are open to real-world evidence. And this IRS data from the 1980s is particularly effective at helping them understand the high cost of class-warfare taxation.

There’s lots of data here, but pay close attention to the columns on the right and see how much income tax was collected from the rich in 1980, when the top tax rate was 70 percent, and how much was collected from the rich in 1988, when the top tax rate was 28 percent.

The key takeaway is that the IRS collected fives times as much income tax from the rich when the tax rate was far lower. This isn’t just an example of the Laffer Curve. It’s the Laffer Curve on steroids and it’s one of those rare examples of a tax cut paying for itself.

Folks on the right, however, should be careful about over-interpreting this data. There were lots of factors that presumably helped generate these results, including inflation, population growth, and some of Reagan’s other policies. So we don’t know whether the lower tax rates on the rich caused revenues to double, triple, or quadruple. Ask five economists and you’ll get nine answers.

But we do know that the rich paid much more when the tax rate was much lower.

This is an important lesson because Obama wants to run this experiment in reverse. He hasn’t proposed to push the top tax rate up to 70 percent, thank goodness, but the combined effect of his class-warfare policies would mean a substantial increase in marginal tax rates.

We don’t know the revenue-maximizing point of the Laffer Curve, but Obama seems determined to push tax rates so high that the government collects less revenue. Not that we should be surprised. During the 2008 campaign, he actually said he would like higher tax rates even if the government collected less revenue.

That’s class warfare on steroids, and it definitely belong on the list of the worst things Obama has ever said.

But I don’t care about the revenue-maximizing point of the Laffer Curve. Policy makers should set tax rates so we’re at the growth-maximizing level instead.

To broaden the understanding of the Laffer Curve, share these three videos with your friends and colleagues.

This first video explains the theory of the Laffer Curve.

This second video reviews some of the real-world evidence.

And this video exposes the biased an inaccurate “static scoring” of the Joint Committee on Taxation.

And once we educate everybody about the Laffer Curve, we can then concentrate on teaching them about the equivalent relationship on the spending side of the fiscal ledger, the Rahn Curve.