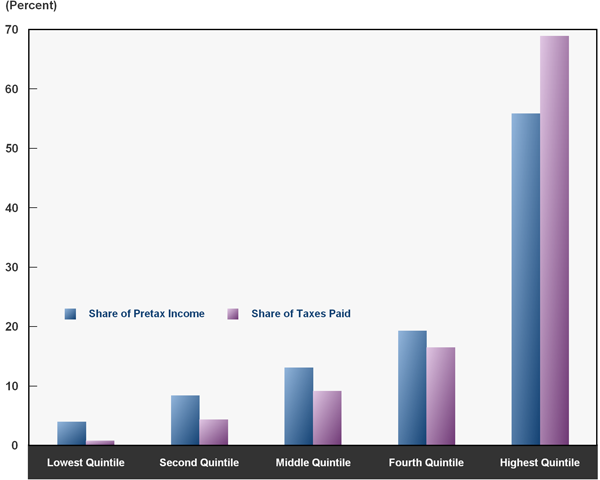

The lazy politician looks at deficits and screams, “soak the rich!” But as CBO’s latest analysis of federal average tax rates shows, they are already paying a highly disproportionate share of taxes.

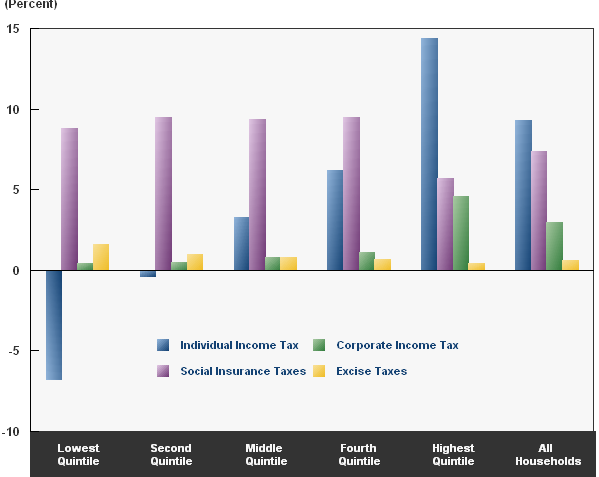

The graphs above show that the highest earners are already paying considerably more in taxes than their share of total income due primary to the individual income tax. This is why the OECD said in 2008 that the U.S. “has the most progressive tax system.” The U.S. beats out France, Sweden and all the other great welfare states for that title.

Politicians that want to further raise taxes have painted themselves into a bit of a corner by adopting such a hyper-progressive income tax structure. Their own past rhetoric prevents broad based increases that might hit lower-income earners, and there just isn’t much room left to soak the rich without returning to the age of Jimmy Carter and stagnation. This is why they’ve turned their attention toward a value-added tax, which is itself a terrible idea.

Politicians are just going to have to accept that they need a different approach to closing deficits, such as reducing the size of our bloated government, than further squeezing our biggest economic producers.