When all you have is a hammer, everything begins to look like a nail. That old saying makes a lot of sense. As a tax economist, I’m sometimes guilty of looking at all sorts of issues based on their relationship with the tax code. In my defense, however, the tentacles of the IRS now reach into almost every nook and cranny of our society. And greedy tax collectors on the state and local level make a bad situation even worse. Two things from today’s inbox illustrate my point.

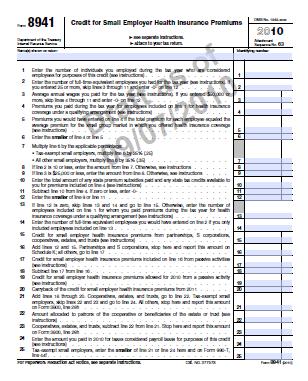

First, you may remember that the IRS is going to be a chief enforcer of Obamacare. Well, our friends at the tax collection agency have just released a draft form for the “credit for small employer health insurance premiums.” We already have a tax system that takes up 72,000 pages and requires more than 1,000 different forms and publications, but now we can add 25 more lines of mind-numbing, eye-glazing bureaucratese, all of which doubtlessly will lead to innocent mistakes that cause many more taxpayers to have nightmarish interactions with the IRS. (click here to see a full-size version of the form)

Second, Hiwa Alaghebandian at the American Enterprise Institute has an article on telecommuting which largely focuses on the environmental and quality-of-live advantages of people working from home. What does this have to do with taxes, you ask? It turns out that greedy state politicians have an annoying tendency of trying to tax people who live elsewhere. This form of taxation without representation imposes both bureaucratic and economic barriers that hinder an otherwise desirable development.

Possibly the biggest barrier to telework are state tax laws. Many states implement some form of double taxation on out-of-state teleworkers. For example, New York applies a “convenience of the employer” doctrine on out-of-state teleworkers who work for a New York–based organization, which requires them to pay income tax to New York for telework days outside of the state. All work done outside of New York is subject to New York income tax, unless the work is done outside of New York out of necessity to the employer . In 2005, the New York State Court of Appeals upheld the “convenience of the employer” doctrine in Huckaby vs. New York State Division of Tax Appeals. Thomas Huckaby, a Tennessee resident, worked for a New York–based company, but teleworked 75 percent of the time. On his New York State nonresident tax returns, Huckaby allocated 25 percent of his income to New York, and 75 percent to Tennessee; however, the New York State tax department determined that Huckaby should have paid New York income tax on 100 percent of his income. The court sided with the New York State tax department, stating that the doctrine was constitutionally applied. As many as 35 states have some form of double taxation for teleworkers.