I recently posted data showing how companies are sitting on lots of cash, presumably in part because the business climate is not conducive to investment and job creation. I also showed a cartoon that makes the same point in an amusing – yet insightful – manner.

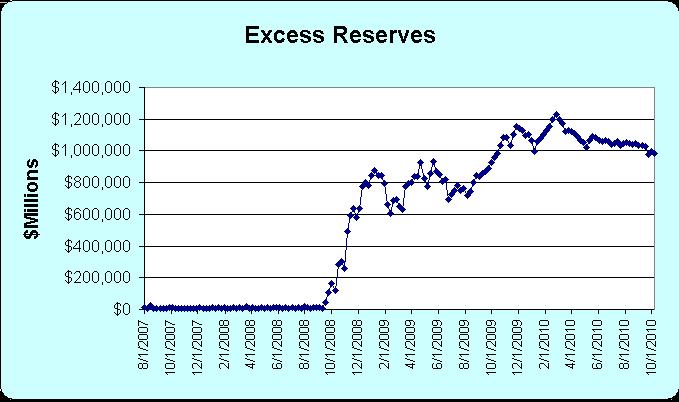

Now let’s look at data from the Federal Reserve, showing the amount of “excess reserves” that banks are holding at the Fed. This is money that is available for loans, but financial institutions apparently don’t see many profitable opportunities to put that money to work. This is perhaps the biggest indictment of Obamanomics since banks exist to make money issuing loans.

Just as I warned in my previous post, there presumably are many factors that are causing banks to keep more reserves than necessary with the Fed. Having been burned during the financial crisis, banks probably would be more cautious, even if Obama was pursuing good policy. Nonetheless, it certainly seems like Obamanomics is just as much of a failure as Bushnomics – which makes sense since both mean bigger government and more intervention.

Just as I warned in my previous post, there presumably are many factors that are causing banks to keep more reserves than necessary with the Fed. Having been burned during the financial crisis, banks probably would be more cautious, even if Obama was pursuing good policy. Nonetheless, it certainly seems like Obamanomics is just as much of a failure as Bushnomics – which makes sense since both mean bigger government and more intervention.