Aftermarket Shock: The High Cost of Auto Parts Protectionism

January 2016

By Brian Garst

Executive Summary

Robust, competitive markets provide tremendous consumer benefits. In the market for collision repair parts the primary – but by no means only – benefit comes in the form of lower insurance premiums. Yet major auto companies have long sought ways to encumber competition in the collision parts aftermarket. Most recently they have turned to the International Trade Commission to sanction a novel use of design patents on individual repair parts to shut out aftermarket competition altogether. This represents a departure from the historic use of design patents to prevent infringement from other manufacturers on an automobile’s overall design.

The resulting restrictions threaten consumer welfare and the competitive health of the market. This paper explores the policy implications of the changing use of design patents and considers an alternative approach adopted by other nations that provides a modified 30-month design protection window for collision parts in order to more appropriately balance the goal of promoting innovation with the interests of consumers.

Introduction

Despite a rash of stories pronouncing the end of the era of the car, Americans continue to prefer the automobile as their primary means of transportation, and U.S. auto production is nearing all-time highs. Americans have not fully shaken off the effects of the recession, however, and recent trends in the manufacture and sale of aftermarket collision auto parts would only further put them in a financial squeeze.

Aftermarket auto parts are those sold in the secondary market, which consists of replacement or accessory parts produced by either the original equipment manufacturers (OEM) or alternative suppliers. This has historically been a competitive market, but a recent change in the use of design patents is threatening to restrict competition in collision repair parts – cosmetic, exterior parts that most typically get damaged in an accident. “Aftermarket parts” hereafter will refer exclusively to non-OEM parts, as the focus of this paper is the impact of alternative, non-branded suppliers on the market for collision replacement parts, their benefits for consumers, and certain regulatory and policy issues impacting their manufacture and sale.

The Aftermarket Parts Industry

Aftermarket parts account for about 14 percent of the collision parts market. Significant recent growth occurred prior to 2010, after which it largely leveled off.1 The percentage of repairable vehicle appraisals including at least one aftermarket part grew considerably over a similar stretch, up from 39 percent in 2009 to 50 percent in 2013, where it also plateaued.2 While the halt in growth is attributable in part to the rebound in new vehicle sales from recession induced lows, policy and regulatory changes restricting competition have also played a role.

Aftermarket Competition Benefits Consumers

A competitive secondary market benefits consumers by reducing the average price of collision and other repair parts. Aftermarket parts compete with OEM brands to provide consumers with greater choice for replacement parts. They can cost between 26-50 percent less than OEM parts.3

Competitive pressure from aftermarket parts suppliers control the cost of OEM parts as well. When automakers monopolized the replacement parts market prior to the mid-1970’s, they enjoyed up to an 800 percent markup on parts sales.4 Facing competition from aftermarket parts has brought prices down, with the overall estimated benefit to consumers to be $1.5 billion per year.5 OEMs also sometimes provide price matching in order to compete with aftermarket suppliers, and continue to search for new strategies to offer competitive prices.6 The secondary market remains attractive to OEMs, however, and to put in perspective the high cost of an OEM monopoly market, a 1999 study found that rebuilding a $23,263 Toyota Camry LE using only OEM parts from Toyota would cost $101,355.7 A more recent 2013 Ford Escape would likewise cost $110,000 by the price of OEM parts alone before labor and other costs are factored in.8

Critics contend that aftermarket parts are not only cheaper in price but also in quality, and that they pose a greater safety risk. Like any market, there are products of varying degrees of quality, but tests frequently show aftermarket parts meeting reasonable safety standards.9 Often times the only difference between an OEM and aftermarket part is the distributor. Automobile manufacturers may not fabricate the part themselves, but instead sometimes subcontract with an independent manufacturer. Some of the same subcontractors also manufacture non-OEM, aftermarket parts.10 When it comes to collision parts, however, the question of safety is a red-herring. The Insurance Institute for Highway Safety says cosmetic, exterior parts “serve no safety or structural function,” and that whether a collision repair part is produced by an aftermarket supplier or an OEM “is irrelevant to crashworthiness.”11

OEM Efforts to Restrict Competition

Auto manufacturers compete in both the primary and secondary markets. Increased competition in recent decades for new car sales in the primary market has put pressure on manufacturers to maximize profits in the secondary market, which includes selling parts and services like maintenance and repairs. To succeed in the aftermarket, manufacturers maintain strong relationships with their dealers, steering customers to the shops where only their brand name parts are used. OEM strategies to maximize profits in the secondary market have also included legal and legislative efforts to undermine use of aftermarket parts and otherwise thwart competition.

Numerous states currently require, to varying degrees of specificity and restrictiveness, either disclosure of the use of aftermarket instead of OEM parts for insurance estimates, or that particular conditions be met before they can be used.12 Manufacturers have also encouraged states to pursue “anti-steering” laws, which prohibit insurers from “steering” customers toward particular shops, some of which might have an arrangement with the policy providers. The laws, often pushed by manufacturers, aren’t always limited to ensuring customers are able to choose between repairers, however. A number go further and inhibit the ability of insurers to even make recommendations, or otherwise restrict commercial speech.13

Consumers benefit from recommendations by experts in an industry with significant information asymmetries, but because insurers are more directly incentivized to consider costs when seeking repairs, the practice threatens OEM efforts to replace primary market profits lost due to growing competition with increased share of the secondary market. As the third-party payer, insurers are most interested in keeping down repair costs. Consumers are potentially impacted by higher costs through increased insurance premiums, but are not likely to account for this fact. Manufacturers seek to exploit this by convincing policyholders that they are being denied the highest quality parts. Disclosure rules are pushed to cast legitimacy on these claims, but can be misleading for consumers who assume that disclosures are only required for unsafe or inferior products.

Complaints have also been lodged that manufacturers “restrict the ability of independent service channels to repair their vehicles by limited access to needed repair information,” and “that key information is restricted to the vehicle manufacturer’s dealership networks.”14 Similar strategies have been observed in other markets. The Competition Commission of India sanctioned 14 car companies, including brands popular in the U.S. market such as Ford, GM, and Toyota, for foreclosing the market to independent repairers by restricting access to spare parts and diagnostic tools, as well as imposing warranty requirements to purchase OEM parts. They were fined 2 percent of their total revenue over three years.15

Evolving Use of Patents

Car manufacturers have long lobbied to protect designs for individual collision parts, but legislators have thus far opted not to do so. What they have not been able to achieve legislatively, however, is now being implemented thanks to a Depression-era law that was created to enforce trade protectionism.

A new strategy that emerged roughly a decade ago has seen manufacturers increasingly turn to design patents to effectively eliminate competition over collision repair parts. Design patents provide 14 years of protection and are available only for ‘ornamental’ designs, whereas functional inventions are eligible for 20-year utility patents. Prior to this, manufacturers patented only the overall appearance of a model to protect against infringement from other manufacturers, not to prohibit competition for parts in the aftermarket.

In 2005, Ford Global Technologies filed a Section 337 case before the International Trade Commission (ITC) – an independent and quasi-judicial agency established in 1930 for dealing with a broad range of trade issues – for alleged infringements on exterior parts for the Ford F150. An Administrative Law judge found that seven patents were valid and issued an exclusion order, which prohibits imports found to be infringing the design patents. Such patents to this point had almost never been used by automakers. The opportunity afforded thanks to globalization to seek interference through a trade body rather than district courts may account for the change in tactic, though similar cases have been brought in more recent years to the district courts as well.

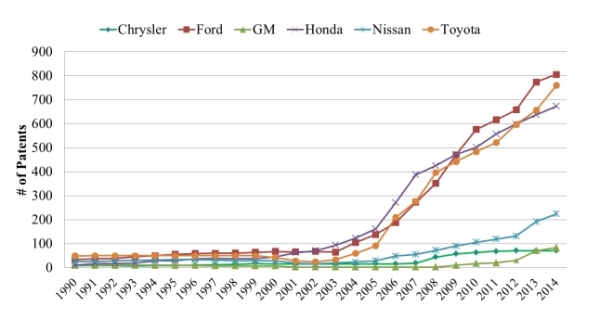

The ITC decision was appealed, but before the process could play out Ford settled the dispute with a confidential agreement that made one of the defendants, “the sole distributor of new non-Original Equipment aftermarket parts protected by Ford design patents,” for a short period of time.16 In turn they pay a royalty and cooperate with Ford in its design patent litigation against other aftermarket manufacturers. In that sense the settlement is said to be “a victory for OEMs seeking to prevent competition from non-OEM manufacturers.”17 Ford and the other OEMs apparently concur, because in the time since Ford’s first actions at the ITC, the use of design patents for collision parts has grown significantly (see Figure 1).

Figure 1

Source: Quality Parts Coalition

Policy Challenges

Patents and other intellectual property rights encourage innovation and provide economic benefits, but like all public policies come with trade-offs. Competition, and its derivative benefits, is sacrificed temporarily in order to encourage investment and innovation, but when rules are overly broad or competition is restricted for an excessive length of time, the benefits can be outweighed by the drawbacks. Such is increasingly the case for the collision parts market.

Design patents provide 14 years of protection compared to 20 years for utility patents. In the market for collision parts, however, that might as well be a lifetime. The average vehicle age has climbed as technology has made automobiles increasingly durable, but at 11.4 years – and typically less when considering only household vehicles – it is still less than the length of design patent protection.18 The few vehicles that might last long enough to see their collision parts lose patent protection are unlikely to attract market investment in alternatives.

A growing body of research finds a one-size-fits-all patent system to be inefficient.19 Multiple avenues are available for tailoring to reduce the inefficiencies introduced by a uniform patent system, including both legislative and judicial responses. The latter lacks the democratic accountability of the former, but also doesn’t suffer from the same politically induced paralysis and can better keep pace with rapid technological changes.20 The evolution in the use of design patents to prevent aftermarket competition in collision parts presents another wrinkle, however, insofar as it occurred through use of Section 337 of the Tariff Act of 1930, which addresses allegedly unfair import practices. The role of Section 337 in patent cases was expanded when Congress in 1974 created the ITC and gave it jurisdiction over Section 337 cases. This foray into patents, however, “negatively impacts the integrity and functionality of U.S. patent law by establishing a dual-track system for patent enforcement.”21 Ford’s subsequent decision to sidestep the district courts and instead pursue its patent litigation through the ITC is significant due to the differences in available remedies between the alternative venues. Whereas the standard remedy in district courts is monetary compensation for past infringement, the ITC has access only to more disruptive injunctive relief through exclusion orders.

In addition, the collision parts market is particularly ill-suited for the use of design patents. The parts exist for no other reason than to restore the automobile to its original appearance. Consumers have no interest in parts that are unable to achieve this, meaning that “Design patents do not merely impede competition in the crash parts market; they eliminate competition.”22

The outcome of this restriction on competition goes beyond the raising of insurance rates. Higher repair costs mean more cars will be totaled out, even for damage that seems relatively minor or might otherwise be repairable. And while manufacturers necessarily cannot innovate the aftermarket parts themselves, they can do so in the manufacturing process, marketing, or distribution of the parts, all of which provides consumer benefits. Without competition, OEMs are unlikely to produce such efficiency gains. Higher repair costs in turn also exacerbate the difficulty consumers face in estimating the lifetime costs of ownership when making new vehicle purchases.

There are proposals to reduce the patent protection window for collision parts to 30 months, during which time development and manufacturing would also be permitted. Considering the issue at hand is limited to constituent parts of a whole design, which itself would maintain the full 14 years protections, this amount of time more than adequately strikes a balance between protecting and encouraging innovation – the ostensible purpose of patent law – without creating an uncompetitive monopoly.

Similar rules have been proposed and adopted in other nations. An EU proposal excludes design protections from component parts of a complex product that were to be used to restore its original appearance. While the effort to harmonize EU law has not yet succeeded, a number of nations – Belgium, Italy, the Netherlands, Poland, Portugal, Spain and the United Kingdom – have already adopted such provisions.23 Nations like Germany and France with strong OEM industries have chosen not to liberalize. In the United States, by contrast, the important policy decisions are not being made by legislators.

Conclusion

The benefit to consumers of a robust aftermarket in collision repair parts is significant. It is reflected primarily in lower insurance premiums and reduced risks of having their vehicles totaled out through access to cheaper parts. The increasing use of design patents to insulate the market from competition has put these consumer benefits in jeopardy.

There are legitimate policy reasons to prefer the use of courts, within a framework granted by Congress, for fleshing out the details of a patent system capable of addressing the varying needs of different industries. However, the ITC’s parallel and duplicative jurisdiction outside of the district courts that have served as the traditional home of patent disputes is likely to continue to produce more problems than it solves. In an increasingly globalized age and industry, applying the Depression-era approach to trade disputes to the modern auto parts market becomes ever more anachronistic. However, the recent decisions enabling protectionism in the market for collision auto parts are in need of serious Congressional scrutiny regardless of the venue. Clearer legislative guidelines are needed, and should have as their top priority the protection of market competition.

Brian Garst is the Director of Policy and Communications for the Center for Freedom and Prosperity.

Endnotes

1. “Crash Course 2015,” CCC Information Services, Inc. http://www.cccis.com/wp-content/uploads/2015/03/CrashCourse-2015_FINAL.pdf ↩

2. Ibid. ↩

3. Statement of Property Casualty Insurers Association of America, House Judiciary Committee, March 22, 2010. http://patentlyo.com/media…2d10.pdf ↩

4. See Matthew W. Rearden, “OEM or non-OEM Automobile Replacement Parts: The Solution to Avery v. State Farm,” Florida State University Law Review, Vol. 28, No. 2, Winter 2001. ↩

5. Frederick R. Warren-Boulton and Daniel E. Haar, “Estimation of Benefits to Consumers from Competition in the Market for Automotive Parts,” Microeconomic Consulting & Research Associates, Inc., www.micradc.com. ↩

6. See Mike Colias and Richard Truett, “GM prepares to fight aftermarket repair parts,” Automotive News, August 3, 2015. http://www.autonews.com/article/20150803/RETAIL05/308039959/gm-prepares-to-fight-aftermarketrepair-parts. ↩

7. Amanda Levin, “OEM Auto Parts Overpriced, Ins. Study Says,” Property Casualty 360, September 10, 1999. http://www.propertycasualty360.com/1999/09/10/oem-auto-parts-overpriced-ins-study-says. ↩

8. Data from LKQ Corporation, Inc. ↩

9. See “Cosmetic crash parts are irrelevant to auto safety,” IIHS, February 17, 2000. http://www.iihs.org/iihs/news/desktopnews/cosmetic-crash-parts-are-irrelevant-to-auto-safety ↩

10. See Matthew W. Rearden, “OEM or non-OEM Automobile Replacement Parts: The Solution to Avery v. State Farm,” Florida State University Law Review, Vol. 28, No. 2, Winter 2001. ↩

11. Stephen L. Oesch, Statement before Massachusetts Legislature’s Joint Committee on Insurance, May 9, 2001. http://www.iihs.org/media/f5c873d4-ede0-4bcc-a17a9bb9b3ae9868/918621715/Testimony/testimony_slo_050901.pdf ↩

12. See Automotive Service Association, “Summary of State Aftermarket Parts Disclosure Laws,” http://takingthehill.com/wp-content/uploads/disclosure.pdf. ↩

13. See Orrin L. Harrison III and J. Carl Cecere Jr., “’Anti-Steering’ Insurance Laws: State Censorship Of Consumer Information Treads On First Amendment Rights,” Washington Legal Foundation, Legal Backgrounder, Vol. 25, No. 6, February 26, 2010. https://www.heartland.org/sites/all/modules/custom/heartland_migration /files/pdfs/27156.pdf. ↩

14. “On the Road: U.S. Automotive Parts Industry Annual Assessment,” U.S. Department of Commerce, 2011. ↩

15. Press Release, “Competition Commission of India Imposes Penalty of Rs. 2544.64 crores on 14 Car Companies,” Press Information Bureau, Government of India, Ministry of Corporate Affairs, August 25, 2014. http://pib.nic.in/newsite/PrintRelease.aspx?relid=109060.

↩

16. Press Release, “Ford Motor Company and LKQ Corporation Settle Patent Disputes,” April 1, 2009. http://www.bloomberg.com/apps/news?pid=conewsstory&tkr=KEYS:US&sid=aMb9oKe9RpSc. ↩

17. Norman Hawker, “Automobile Aftermarkets: A Case Study in Systems Competition,” The Antitrust Bulletin: Vol. 56, No. 1, Spring 2011. ↩

18. “National Transportation Statistics,” Bureau of Transportation Statistics, Table 1-26, http://www.rita.dot.gov/bts/…/national_transportation_statistics/html/table_0 1_26.html. ↩

19. See Michael W. Carroll, “One for All: The Problem of Uniformity Cost in Intellectual Property Law,” American University Law Review 55 (2006): 845–900. ↩

20. See Dan L. Burk and Mark A. Lemley, “Courts and the Patent System,” Regulation, Cato Institute, Summer 2009. http://object.cato.org/sites/cato.org/files/serials/files/regulation/2009/6/v32n2-3.pdf. ↩

21. K. William Watson, “Still a Protectionist Trade Remedy: The Case for Repealing Section 337,” Cato Institute, Policy Analysis No. 708, September 2012. http://www.cato.org/publications/policy-analysis/still-protectionisttrade-remedy-case-repealing-section-337. ↩

22. Norman Hawker, “Automobile Aftermarkets: A Case Study in Systems Competition,” The Antitrust Bulletin: Vol. 56, No. 1, Spring 2011. ↩

23. Press Release, “European Commission: proposal for amending the Designs Directive and harmonizing the aftermarket by introducing a ‘repair clause’ withdrawn,” Bardehle Pagenberg, July 14, 2014. http://www.lexology.com/library/detail.aspx?g=f22c828c-3beb-471e-8c67-3ad27b15ec8b. ↩