When I debate class warfare issues, here’s something that happens with depressing regularity.

I’ll cite research from a group like the Tax Foundation on how an overwhelming share of the income tax is borne by upper-income taxpayers.

The statist I’m arguing with will then scoff and say the Tax Foundation is biased, thus implying that I’m sharing bogus data.

I’ll then respond that the group has a very good reputation and that their analysis is directly based on IRS data, but I may as well be talking to a brick wall. It seems leftists immediately close their minds if information doesn’t come directly from a group that they like.

So I was rather happy to see that the Internal Revenue Service, in the Spring 2015 Statistics of Income Bulletin, published a bunch of data on how much of the income tax is paid by different types of taxpayers.

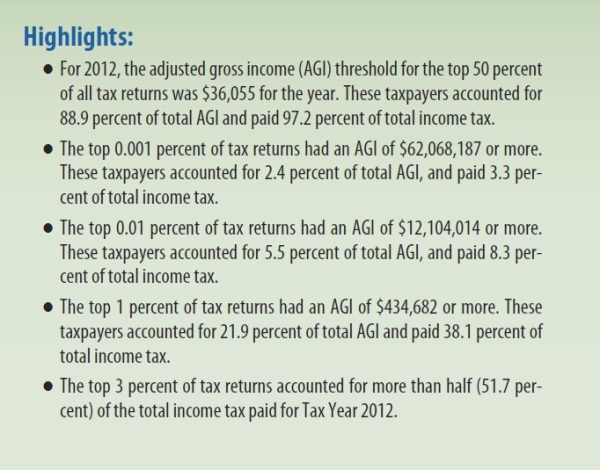

I’ll be very curious to see how they respond when I point out that their favorite government agency admits that the bottom 50 percent of earners only pay 2.8 percent of all income tax. And I’ll be even more curious to see how they react when I point out that more than half of all income taxes are paid by the top 3 percent of taxpayers.

There’s a famous saying, generally attributed to Daniel Patrick Moynihan, that “Everyone is entitled to his own opinion, but not his own facts.”

With this in mind, I’m hoping that this data from the IRS will finally put to rest the silly leftist talking point that the “rich” don’t pay their “fair share.”

This doesn’t mean, by the way, that the debate about policy will be settled.

Getting statists to accept certain facts is just the first step.

But once that happens, we can at least hope that their minds will be opened to subsequent steps, such as understanding the economic impact of punitive tax rates, recognizing that high tax rates won’t necessarily collect more revenue, or realizing that ordinary workers suffer when harsh tax policies reduce economic vitality.

Though I’m not holding my breath and expecting miracles. After all, some leftists openly state that they don’t care if the economic damage of high tax rates is so significant that government doesn’t collect any tax revenue.

You can see an example of one of these spite-motivated people at the 4:20 mark of the video I narrated on class-warfare taxation.