Europe is in deep trouble.

That’s an oversimplification, of course, since there are a handful of nations that seem to be moving in the right direction (or at least not moving rapidly in the wrong direction).

But notwithstanding those exceptions, Europe in general issuffering from economic stagnation caused by a bloated public sector. Barring dramatic change, another fiscal crisis is a virtual certainty.

A key problem is that Europe’s politicians suffer from fiscal incontinency. They can’t resist spending other people’s money, regardless of all the evidencethat excessive government spending is suffocating the productive sector of the economy.

Yet some of them cling to the discredited Keynesian notion that government spending “stimulates” economic performance. Writing for the Wall Street Journal, Brian Wesbury explains why European politicians are wrong.

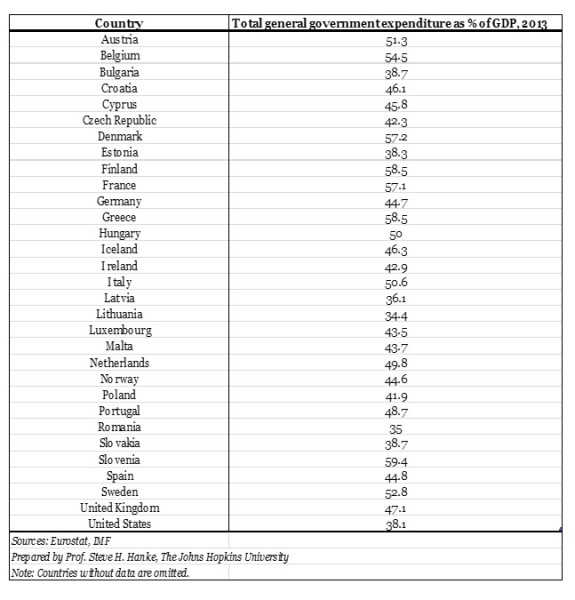

We need less government, not more, and yet governments are engaged in deficit spending like they did in the 1970s. It didn’t work then to boost growth, and it isn’t working now. Euro area government spending was 49.8% of GDP in 2013 versus 46.7% in 2006. In other words, euro area governments have co-opted an additional 3.1% of GDP (roughly €300 billion) compared with before the crisis—about the size of the Austrian economy. France spent 57.1% of GDP in 2013 versus 56.7% in 2009, at the peak of the crisis. This is the opposite of austerity—but the French economy hasn’t grown in more than six months. It is no wonder S&P downgraded its debt rating. Italy, at 50.6% of GDP, is spending more than the euro area average but is contracting faster.

Brian isn’t the first person to make this observation.

Constantin Gurdgiev, Fredrik Erixon, and Leonid Bershidsky also have pointed out the ever-increasing burden of government in Europe.

And I can’t count how many times I’ve also explained that Europe’s problem is too much government.

The problem with all this government spending, as Brian points out, is that politicians don’t allocate resources very intelligently. So the net result is that labor and capital are misallocated and we get less economic output.

Every economy can be divided into two parts: private and public sectors. The larger the slice taken by the government, the smaller the slice left over for the private sector, which means fewer jobs and a lower standard of living. If government were more productive than private business this wouldn’t be true, but government is not.

Let’s be thankful, by the way, that the United States isn’t as far down the wrong road as Europe.

And this is why America’s economy is doing better.

The U.S. is growing faster than Europe not because…our government is relatively smaller. Federal, state and local expenditures in the U.S. were 36.5% of GDP in 2013. This is too high, but because it is less than Europe, the U.S. has a larger and more vibrant private sector.

Ironically, even President Obama agrees that the U.S. economy is superior, though he (predictably) is incapable of putting 2 and 2 together and reaching the right conclusion.

My Cato colleague Steve Hanke (using the correct definition of austerity) also has weighed in on the topic of European fiscal policy.

Here’s some of what he wrote for the Huffington Post.

The leading political lights in Europe — Messrs. Hollande, Valls and Macron in France and Mr. Renzi in Italy – are raising a big stink about fiscal austerity. They don’t like it. And now Greece has jumped on the anti-austerity bandwagon. …But, with Greece’s public expenditures at 58.5 percent of GDP, and Italy’s and France’s at 50.6 percent and 57.1 percent of GDP, respectively — one can only wonder where all the austerity is (see the accompanying table). Government expenditures cut to the bone? You must be kidding.

Here’s Professor Hanke’s table. As you can see, the burden of government spending is far above growth-maximizing levels.

That’s a very depressing table, particularly when you realize that governmentused to be very small in Europe. Indeed, the welfare state basically didn’t existprior to World War II.