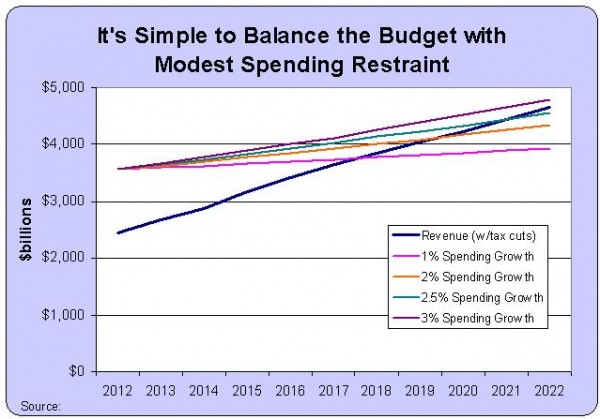

Now that new numbers have been released by the Congressional Budget Office, it’s time once again for me to show how easy it is to balance the budget with modest spending restraint (though please remember our goal should be smaller government, not fiscal balance).

- I first did this back in September 2010, and showed that we could balance the budget in 10 years if federal spending was limited so it grew by 2 percent annually.

- I repeated the exercise in January 2011 after new CBO numbers were released, and re-confirmed that a spending cap of 2 percent would eliminate red ink in just 10 years.

- In August of that year, following the release of the CBO Update, I showed again that the budget could be balanced by limiting spending so it climbed by 2 percent per year.

- Most recently, back in January after CBO produced the new Economic and Budget Outlook, I crunched the numbers again and showed how a spending cap of 2 percent would balance the budget.

I’m happy to say that the new numbers finally give me some different results. We can now balance the budget if spending grows 2.5 percent annually.

In other words, spending can grow faster than inflation and the budget can be balanced with no tax hikes.

And here’s the video I narrated almost two years ago on this topic. The numbers have changed a bit, but the analysis is exactly the same.

In other words, ignore the politicians, bureaucrats, lobbyists, and special interests when they say we have to raises taxes because otherwise the budget would have to be cut by trillions of dollars. They’re either stupid or lying (mostly the latter, deliberately using the dishonest version of Washington budget math).

Modest fiscal restraint is all that we need, though it would be preferable to make genuine cuts in the burden of government spending.